Why AXIS?

Cross-class solutions

The energy industry is transforming as demand intensifies for more sustainable, diverse sources of power.

The transition to a resilient lower-carbon economy depends on innovation and long-term strategic thinking, supported by insurance partners that understand the complexities, the risks, and the potential of new and varied energy technologies.

AXIS Energy Transition Syndicate 2050 (S.2050) brings together cross-class expertise to provide holistic, specialty risk solutions for activities and assets associated with replacing or displacing fossil fuels with lower-carbon alternatives during the energy transition phase.

Greater Certainty

Every business is unique, requiring a varied mix of insurance coverage especially as they invest, develop, and engage with more sustainable energy sources and practices. When multiple risks require coverage, there often comes multiple insurers, opening up the potential for cover gaps, inconsistencies and even dual insurance. AXIS provides greater certainty – you have one route to access the lead insurance capacity needed for your customers as they progress on their energy transition journey.

Ease of Access

For any risks that fall within our S.2050 appetite, please contact your usual AXIS underwriter.

If the risk requires multiple lines of cover, you will be assigned one key point of contact. Your contact will coordinate with lead underwriters from the diverse lines of business within AXIS that the customer requires along their energy transition journey.

Report: Navigating Risk in the Energy Transition

The energy transition is among the biggest challenges of our day. To understand more about what businesses need from the insurance industry, and the barriers and motivators they face in their energy transition journeys, we commissioned extensive research of 600 energy stakeholders. Read the report Navigating Risk in the Energy Transition to find out more.

AXIS in partnership with FT Live

Managing Risk For Energy Transition Projects

Learn how collaboration between developers, lenders, investors and insurance partners is key to supporting customers to deliver renewable energy projects with lifetime resilience in this Financial Times “FT Live” webinar.

Watch on-demand to hear energy industry experts plus AXIS President and CEO, Vince Tizzio and Richard Carroll, Head of Global Energy Resilience discuss:

Contrasting Perspectives

Understanding the contrasting risk perspective of developers, lenders, and insurers

Insurance Implications

Navigating the insurance implications of new technologies, larger project scales, and untested locations

Leveraging Data

How insurers leverage their cross-project data to advise on emerging risks and best practices

Activities and assets in scope

We provide cover for risks which are a demonstrable part of global energy transition. The activity or asset being covered will be allowing the company, organization, or country to strategically move from a reliance on carbon-based products to more sustainable energy sources and practices.

Activities in scope

- The replacement of existing, fossil fuel assets with renewable energy capacity

- The displacement of energy capacity with renewable energy capacity. The construction of renewable energy assets may exist alongside fossil fuel assets in emerging and developing economies

- Construction of Liquified Natural Gas (LNG) and gas-fired assets only where the asset will reduce the organization or country carbon footprint

- Projects which improve or mitigate the impacts of existing energy technology

Enabling and supporting activities which are essential to the above are also in scope. For example, liabilities associated with the financing of energy transition projects.

Assets in scope

- Predominantly power generation including hydropower, renewable energy, nuclear, biomass, gas fired power plants, LNG power plants, hydrogen production, carbon capture/storage

- Storage and conversion technologies including battery plant and EV battery construction, hydrogen manufacturing, LNG terminals, hydrogen-ready pipeline retrofitting

- Crucial distribution infrastructure for electricity distribution including battery storage, transmission networks and plants, cross border interconnectors

- Decommissioning and disposal of ‘old’ infrastructure in the support of the above

Enabling and supporting activities which are essential to the above are also in scope. For example, liabilities associated with the financing of energy transition projects.

SOLUTIONS

Specialty solutions tailored to your needs

AXIS Energy Transition Syndicate 2050 provides innovation, expertise, and solutions across all stages of the project lifecycle.

Cover for risks relating to the funder/s and capital manager/s of energy transition activities. This includes:

- Credit & Political risks – Financial products that are direct or adjacent to investment in energy transition technology. Includes emerging market banks and major infrastructure investors

- Professional Lines risks – This includes D&O, PI, Crime protection for investment managers/banks and fund vehicles that are investing specifically in energy transition activities and assets

Covering the transit, movement and storage of technologies, raw materials and non-fossil fuels required for energy transition projects and activities. This includes, but is not limited to:

- Batteries and battery storage systems

- EVs

- Solar PV

- Wind turbine components

- Biomass

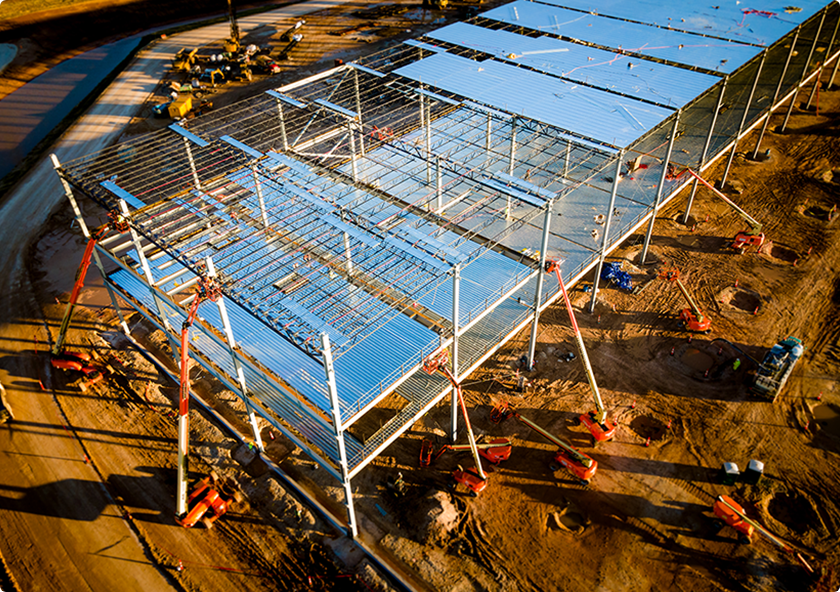

Covers all-risks property damage, extending from natural catastrophes to design consequences, for a wide range of developments including:

- Hydropower construction

- Gas-fired power plants

- Biomass plant construction

- Battery plant construction

- Construction of plants to produce low-carbon alternatives to existing materials e.g. green concrete or green steel

- Alternative fuels production e.g. hydrogen

- Liquified Natural Gas facilities

Additional coverage can be provided during the construction phase including:

- Professional Indemnity

- A&H

Covers risks related to the ongoing operation of energy transition assets once constructed. This includes:

- Property and associated coverages

- Liability

- Business Interruption

- Accident & Health

- Political Violence

- Cyber

Providing covers for risks related to the decommissioning or disposal of old technologies as they are replaced with cleaner solutions such as Construction and Marine Cargo coverages.

Cover for risks relating to the funder/s and capital manager/s of energy transition activities. This includes:

- Credit & Political risks – Financial products that are direct or adjacent to investment in energy transition technology. Includes emerging market banks and major infrastructure investors

- Professional Lines risks – This includes D&O, PI, Crime protection for investment managers/banks and fund vehicles that are investing specifically in energy transition activities and assets

Covering the transit, movement and storage of technologies, raw materials and non-fossil fuels required for energy transition projects and activities. This includes, but is not limited to:

- Batteries and battery storage systems

- EVs

- Solar PV

- Wind turbine components

- Biomass

Covers all-risks property damage, extending from natural catastrophes to design consequences, for a wide range of developments including:

- Hydropower construction

- Gas-fired power plants

- Biomass plant construction

- Battery plant construction

- Construction of plants to produce low-carbon alternatives to existing materials e.g. green concrete or green steel

- Alternative fuels production e.g. hydrogen

- Liquified Natural Gas facilities

Additional coverage can be provided during the construction phase including:

- Professional Indemnity

- A&H

Covers risks related to the ongoing operation of energy transition assets once constructed. This includes:

- Property and associated coverages

- Liability

- Business Interruption

- Accident & Health

- Political Violence

- Cyber

Providing covers for risks related to the decommissioning or disposal of old technologies as they are replaced with cleaner solutions such as Construction and Marine Cargo coverages.

Capabilities

- Line size:

- Renewable Energy $100 m/€100 m

- Construction $65 m (PML)

- Credit $40 m

- Political Risks $50 m

- Project Cargo $75 m

- Offshore Energy $75 m

All other product lines, please speak with your AXIS underwriter.

- AXIS Energy Transition Syndicate 2050 offers the risk protection that businesses, governments, and public entities need during every stage of their energy transition lifecycle, including:

- Conception and invention

- Securing financing

- Sourcing and moving goods or materials

- Construction

- Operations and maintenance

- Dismantling and repurposing

Contact US

Your AXIS team

Claims

We deliver on our promises

Effective resolution for customers is achieved with our highly skilled claims specialists focusing on:

- Quick decision making

- Championing your needs

- An honest approach

∗Claims examples may be based on actual cases, composites of actual cases or hypothetical claim scenarios and are provided for illustrative purposes only. Facts have been changed to protect the confidentiality of the parties. Whether or to what extent a particular loss is covered depends on the facts and circumstances of the loss, the terms and conditions of the policy as issued and applicable law.

Related

What’s happening at AXIS

Related news and updates across the organization

Find your future at AXIS

We are a global insurer and reinsurer tackling unique challenges. At the heart of it all? Our people. As unique as the risks we face.